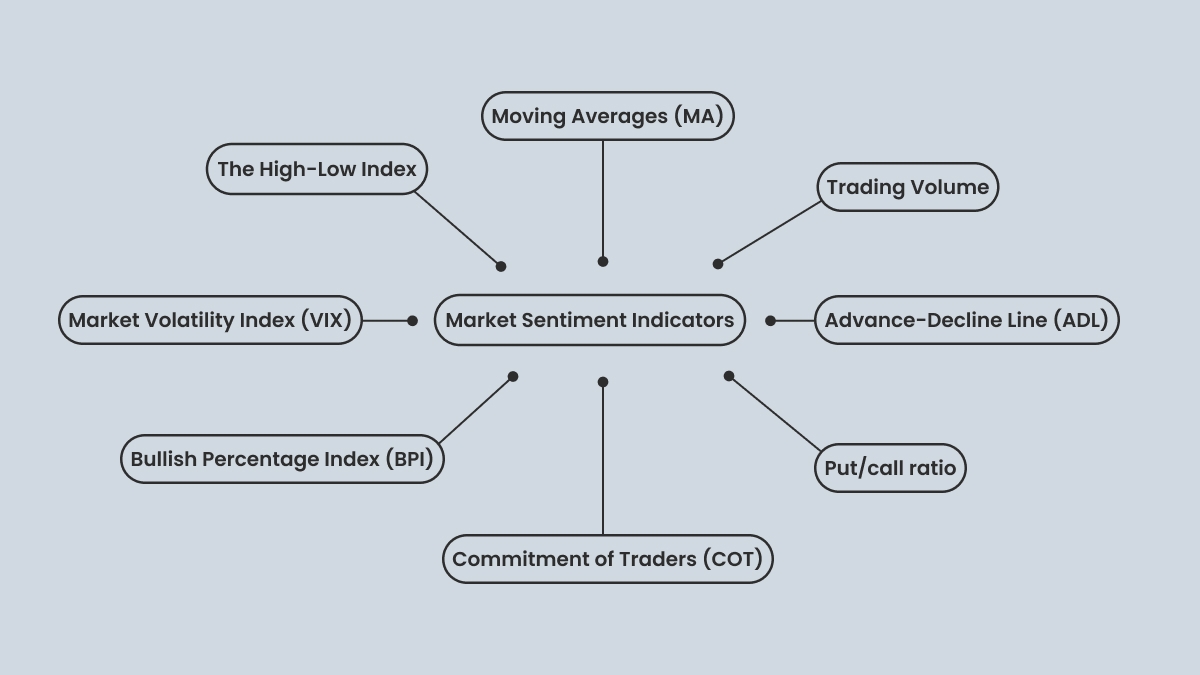

The stock market is driven by the emotions of its participants, while fundamental value is about real business performance. Usually, market sentiment reflects the reaction of investors to different events, so this indicator may come out too late to be relevant, or may not demonstrate the real state of affairs. Always be careful with market sentiment indicators, because they can interfere with long-term investments.

Moreover, you should remember that the media can affect market sentiment significantly. Overly optimistic narratives can create bubbles, while negative news cycles may lead to panic selling. For instance, the media could increase the concern of investors during periods of economic uncertainty. Furthermore, there is a study that proves that sentiment in the media can identify early warning signs of an economic crisis.

You should not rely on market sentiment alone — there are other indicators for market analysis. For example, if the indicator shows bearish sentiment, and technical analysis demonstrates support for the business, then an investor may buy shares. Otherwise, a bullish sentiment combined with signs of overvaluation from fundamental analysis might require a more careful approach.

Examples

Swings in the stock market between bullish and bearish sentiments are usually driven by uncertainty in economy and policy. For example, in the beginning of 2020 market sentiment was mostly bearish. Investors were expecting an economic crisis. Stocks were being sold massively, and prices were going down. Nevertheless, when governments took measures to stimulate the economy and scientists tested vaccines, investors became more positive, triggering a strong market recovery.

Sometimes social media can affect market sentiment. Just remember Tesla and its CEO Elon Musk. Tesla stocks fall and sentiment changes from optimistic to pessimistic on the back of his ambiguous social media publications, while the real state of affairs in the company is stable and there are no objective reasons for such a big fall.